A. Quick Exercises using DSCR

This tutorial focuses on the Debt Service Coverage Ratio (DSCR), which is widely used in project finance models. It is a debt metric used to analyse the project’s ability to repay debt periodically. DSCR = Cash Flow Available For Debt Service (CADS) / debt service (DS) (principal + interest)

Definitions of DSCR

There are other definitions of DSCR that are used in fields outside project finance. In corporate finance, it refers to the amount of cash flow available to meet annual interest and principal payments on debt, including sinking fund payments. In personal finance, it is a ratio used by bank loan officers in determining income property loans. The ratio of over 1.0 x would mean the property is generating enough income to pay its debt obligations.

Calculating Debt Service Annually

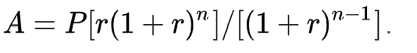

This is the proper formulae

but you can go to the link below to get the amortization schedule

B. Excel Essentials for Infrapreneurs

Click below to download Excel Exercises & Workbook

C. Application of Financial Models using LPCT

Click below to download Sample Financial Model

Download 03 – Sample Project Finance Model