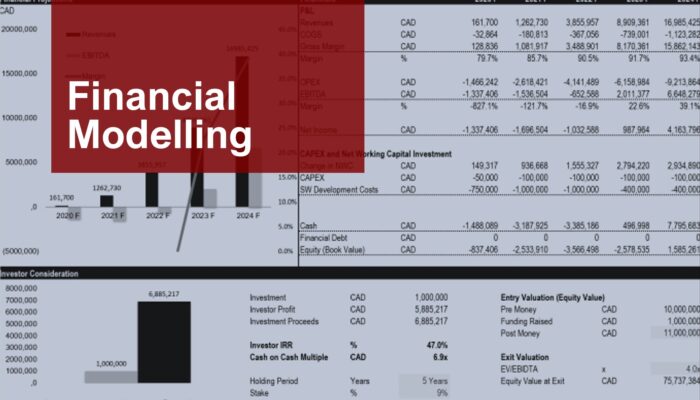

Infrastructure Financial Modelling is used to assess the risk-reward of lending to and investing in any commercial project. The project’s debt capacity, valuation and financial feasibility depend on expected future cash flows generated by the project itself and a financial model is built to analyze this.

At Brickstone we understand that every project is unique and factors that affect project outcomes can change quickly. Brickstone is very experienced in financial modelling that can quickly test changing variables and facilitate rapid model optimisation for changes in key project drivers.

We work typically work closely with Project Sponsors to Plan, Structure and Analyze project-specific financial models designed using practical, structured design rules to meet the project objectives.

Brickstone Infrastructure Financial Modelling

We help Project Sponsors in preparing financial models and conducting independent reviews of financial models, in order to:

1. Obtain financing and determine the optimal financing structure of the project company;

2. Determine the effects of the investment project / revised strategy ;

3. Ensure methodological compliance of the model with international standards; and

4. Overview of the assumptions adopted in the model, in terms of their consistency and compliance with formulas, assumptions or provisions adopted in the project agreements.