Project Financing From Commercial Sources

Introduction

This article describes the various Project Financing from Commercial Sources in Local and International Lenders been sourced by project sponsors.

A project sponsor is in charge of securing the financing and general asset spending endorsement and claims the open doors and dangers identified with the money related result of the project. Project sponsors may include government department, international agencies, public corporations or parastatal entities.

The sponsor’s objective may include political, material inputs, marketing, technical, management and financial aspects, but they usually relate to the sponsor’s wish to exploit its particular resources.

The owner of the project and the project sponsor do not have to be the same, and on many major capital projects the shareholders of the sponsor can only guarantee the large financial resources required by using the project‘s future cash flow, hence the term “project finance”.

The aim of most project financing is to arrange to borrow for a project which will benefit the sponsor and at the same time be completely non-recourse to the sponsor (i.e. in no way affect its credit standing or balance-sheet). Hence, project financing is often referred to as off-balance-sheet financing.

Few projects are financed independently on their own merit without credit support from sponsors or other interested third parties.

Capitals in Project Financing From Commercial Sources

There are three main types of capital available to finance the project through either off-balance-sheet finance. These are explained below:

- “Equity” investment represents the risk capital and most junior debt. It provides the basis for lender or investors to advance more senior forms of capital to the project.

- Quasi-equity: represents the loans or advance made to a project, and are senior to equity capital, but junior to senior debt and secured debt.

- Senior debt: can take the form of either secure or unsecured loans. Most borrowing from commercial lenders for project financing will be in the form of senior debt. Senior debt has the priority of payment if the borrower gets into financial difficulty.

Commercial Debt Financing Types

Commercial loans are the most important sources of senior debt for project financing and may involve a single lender, several lenders or a loan syndicate.

These types of capital may be in the form of construction loans, long term loans, or working capital loans. The following details should be covered in the loan agreement:

- The amount which may be borrowed;

- Commitment fees for overdraft or term loans that are not fully used;

- Term of the loan and repayment schedule;

- The interest rate on the outstanding balance;

- Procedure for take-down and conditions precedent for the take-down;

- Representations and warranties (i.e. guarantees that loan will be available) of the borrowing;

- Legal opinions which will be required at the close of the loan agreement;

- Affirmative covenants (i.e. agreements relating to a specific action to be taken);

- Financial covenant (i.e. financial agreements);

- Responsibility for any withholding of tax on interest;

- Enforceability of the right of the lender.

The element of risk associated with the provision of a loan must be reflected in the interest rate. Moreover, there are several mechanisms available that can be used to reduce the cost of borrowing by decreasing the lender’s risk.

1. Unsecured loans.

Unsecured loans are available when the debt is backed by the general credit of the borrower and is not secured by a security interest in any assets or pool of assets. This is often to as “name lending”.

Unsecured loans are available to projects whose sponsors, owners and managers have established a good reputation with the financial community and where sufficient capital or subordinated loans have been provided to meet the equity risk capital requirement of the project.

2. Secured loans.

Secured loans are available to most project where the assets securing the debt have value as collateral; such assets must be marketable and readily convertible into cash.

The collateral of real property, personal property, payment due under a take-or-pay contract and assignment of the contractual right are all used as collateral under project financing.

3. Syndicated loans.

Commercial banks in Nigeria are the largest source of project loan but tend to limit their commitment to between two and five years, with a floating interest rate based on NIBOR or the MPR Rate. However, a longer loan period can be negotiated and fixed interest rate loans for five to ten years of maturity are sometimes available if there is liquidity.

The size of some project is such that the large loans required to finance them have to be provided through a syndicated international commercial bank.

The general advantages of the syndicated loan market are that;

- A substantial amount of debt can be raised;

- Loans may be made in any of several currencies;

- Risk can be shared;

- Banks involved in syndicated loans are sophisticated and are able to understand and participate in the complex credit risk presented by project financing;

- The take-up date of the loan can be flexible; and

- Pre-payment is customarily permitted.

Commercial Debt Financing Options and Terminologies

Large commercial finance companies are another potential source of funds for project financing. Compared to banks or insurance companies, finance companies do not have a depositor base of policy-holders as a source of funds. They must buy their fund in the debt markets and re-lend at a spread. Consequently, funds from commercial finance companies tend to be highly-priced and limited in volume.

Other sources of fund-raising include leasing companies, and so on.

1. Normal balance sheet financing.

Banks providing normal balance sheet lending must satisfy themselves that the borrower’s total financial structure is sufficient to pay interest as well as repay the loan. In normal balance sheet financing, a company will borrow money from a bank, the debt will appear on the company’s balance sheet, and in most cases, the assets shown on the company’s balance sheet will act as the banks’ security.

However, if the company wishes to invest in a specific project, it is possible to safeguard the company’s asset by creating an off-balance-sheet arrangement.

Some of the instrument used to raise fund to finance the project are listed below:

- Commercial sources (equities and debt: commercial banks, etc.);

- Syndicated bank and Eurodollar loans;

- Eurodollars;

- Eurodollar bonds;

- Leases;

- Commercial paper market.

2. Pure project financing.

There is a wide range of financing alternatives accessible; however, loan specialists will typically require some kind of security to be offered. Pure project financing will just happen when the credit’s security is totally based on the project cash flow.

Attributable to the mind-boggling nature of most projects, it is once in a while conceivable to accomplish this circumstance. Loan specialist giving project financing must along these lines guarantee that there will be sufficient income created by the project to pay intrigue and reimburse capital after every other cost have been met (e.g. running expense, charges).

In the project financing, the loan specialist will in this way assess the project in detail, instead of the activists of the support. Project financing is now and again alluded to as a cockeyed sheet fund or non-response back. The explanations behind choosing project financing to accomplish the support’s target could be to:

- Enable the support to embrace a project that would have generally been unthinkable and to get the advantage of huge capital resources without financing it;

- Minimize the support’s value commitment by drawing in different financial specialists from either the private or the general population segment;

- Shift a portion of the hazard far from the support on to the project;

- Help the support to raise advance on preferred terms over would have been accomplished through direct getting; and

- Keep the project in advance of the support’s monetary records and accomplish a larger amount of equipping.

The utilization of these terms can some of the time deceive ‘reeling sheet fund’ implies that the back isn’t given by a credit secured against the accounting report resources. “Non-plan of action back” implies that there is no credit reimbursement ensures gave by either the borrower or the parent organization.

The utilization of certifications can regularly give moneylender a misguided sensation that all is well and good. It ought to never be accepted that certifications can without much of a stretch be authorized.

Underwriters can discover many reasons for non-installment and the loan specialist must hold its rights. The current disappointments in Italy, where the Government is declining to acknowledge obligation for the as yet exceptional advances of one of its entirely possessed auxiliaries, feature the issue.

3. Performance bonds.

With any major project come the inherent risk factors associated with accidents on-site, additional construction cost, completion delays and future cash flow.

It is vital that bankers or sponsors reduce these risks or share them out with others through the correct guarantees, insurance and bonds. Several types of bond are available to ensure completion or performance under a construction contract and these can be used to provide some extra assurance to the project lender.

The most common bonds are:

- Performance bonds;

- Tender bonds;

- Advance bonds;

- Retention bonds; and

- Maintenance bonds.

4. Owner/sponsor guarantees.

The owner of a project is the most obvious guarantor of a project financing transaction. However, subsidiaries established to run a project are often undercapitalized and have no established track record, leading to poor credit rating.

Project lenders will therefore require a guarantee from a creditworthy source, often involving the parent company. In most cases, this type of debt guarantee will appear as a liability on the consolidated balance sheet of the owner or sponsor. However, there are other forms of a direct and indirect undertaking which, if structure correctly, a sponsor can treat as off-balance-sheet liabilities.

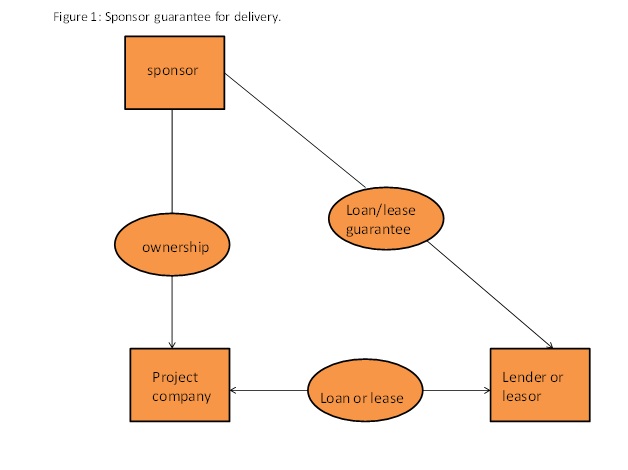

The sponsor may or may not be interested in owning a facility that needs to provide it with a product or service. Figure 1 illustrates the process which will result in the sponsor owing to the completed facility.

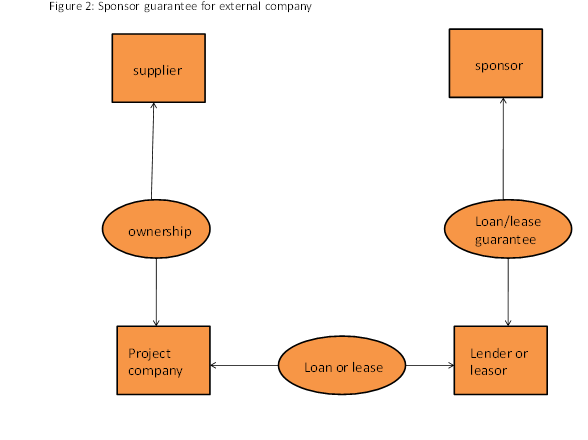

Figure 2 illustrate the mechanism that the sponsor must establish if it does not wish to own the completed project but is ready to act as a guarantor. The arrangement illustrated in figure 1&2 are both direct guarantees

The next figure 2: Sponsor Guarantee for an external company

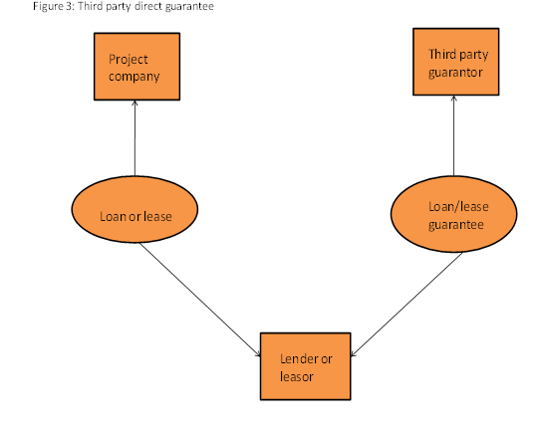

5. Third-party direct guarantees.

One objective of project financing is to ensure that no single part carries the financial burden or risk with the project. Achievement of this is possible by combining different types of guarantee or undertaking from various parties in the form of bankable credit.

Guarantees enable sponsors to transfer the financial risk of a project to a third party. This mechanism allows off-balance-sheet financing to take place, without which some project would not be possible.

Third-party guarantors must benefit from the transaction in other to make their involvement worthwhile. Any guarantor is thus, to some extent, a project sponsor. The advantage of third party guarantees is that the owner or sponsors (non-guarantor) are able to keep their liabilities off the balances sheet.

It is possible to categorize third-party guarantors into the following group:

- Suppliers;

- Seller;

- Users;

- Contractors; and

- Government agencies.

There is a guarantee of the loan/lease obligations of the project company by a third party who does not wish to own or control the project company. Based on this guarantee, the project company is able to enter into a loan or lease agreement with the lender or leasing company.

6. Third party indirect guarantees.

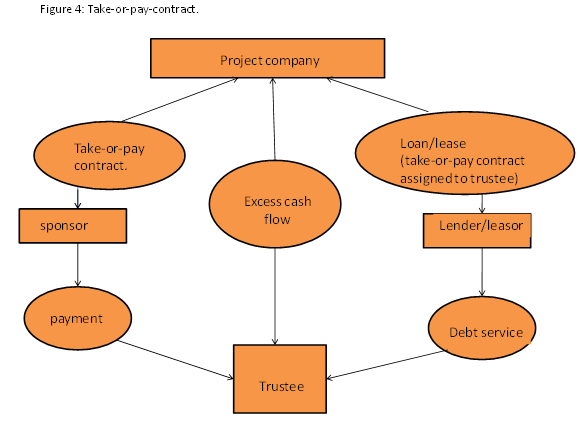

Third-party indirect guarantees can take the form of “take or pay contract” or “throughput contracts”, and can be used to ensure a steady flow of fund once a project has been completed. These may include a supplier setting a fixed price for raw material over a predefined period, or the user of the project’s output agreeing to take a set quantity of goods at a fixed price.

These types of arrangement are often sufficient to assure lenders of the project’s viability. A trustee (usually a bank) should act as an intermediary and, by controlling the flow of money, provide additional assurance to the lender.

7. Take-or-pay contracts.

A take-or-pay contract is an administer organizing transactions amongst companies and their suppliers. With this sort of agreement, the company either takes the item from the supplier or pays the supplier a punishment. Figure 4 represents an ordinary take-or-pay contract.

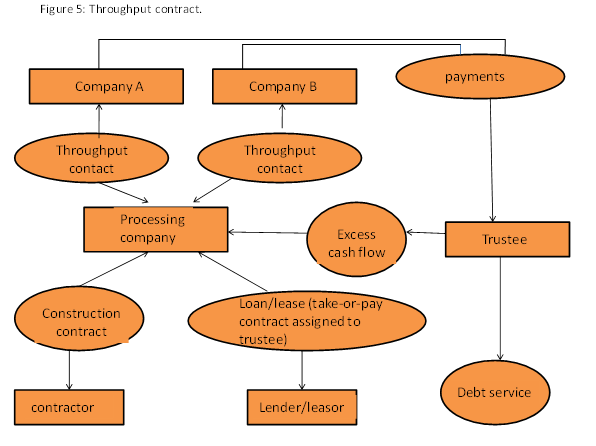

8. Throughput contracts.

A throughput contract is usually an agreement between the owners of a transportation or processing facility and the potential users of that facility,(e.g. an oil pipeline), whereby the users agree periodically to pay a set amount in return for the processing or transportation of a product.

The users should provide an agreed minimum quantity for each period and have to pay even if the contracted quantity is not provided. Throughput contract signed prior to construction can act as guarantees to future income and thus help to raise the funds required to finance the project.

Figure 5 illustrates an arrangement for a typical throughput agreement.

This agreement secures a loan for the building of a processing plant. A construction contract forms between the processing company and the contractor. In this example, there are two sponsors who have throughput contracts with the processing company.

The processing company enters into a loan and lease agreement whereby due under the throughput contract is assigned to a security trustee, who uses these to service the debt, any excess cash being paid to the processing company.

The throughput contract signed by company A and company B must be disclosed in the companies’ consolidated balance sheet.

Funding policy: Case Study of BAA.

As an example, the British Airport Authority (BAA) funding policy in the 90s was to finance a major British construction project by using the debt instrument in preference to equity. However, there are favours for equity issues when there is a consideration for an international project.

To fund its operation, the company has to make use of both short-term and long-term finance. For example, long-term loans at a fixed rate are used to build new runways or terminal building, but fixed-rate, medium-term loans are often used for smaller projects. It is the responsibility of BBA’s treasurer to negotiate with the capital market and obtain a debt that is best for the company in general.

This will involve assessing the cost of the debt in both financial and tax terms, and determine the associated risk and possible remedies. BAA’s corporate philosophy has been to give considerable autonomy to its subsidiaries.

However, it does have a central treasure in order to:

- Control and implement the group’s strategy;

- Reduce overall finance cost;

- Ensure the full utilization of assets.

- Ensure a good distribution of fund through the regional offices; and

- Negotiate favourable borrowing terms with the banks.

Over the years, BAA’s has selected the following financial instruments which are considered the best suit the company’s requirement. The funding of the project is not restricted to these sources, and new approaches are considered so long as they are beneficial to the company.

- Short -term finance: are wellsprings of finance that are accessible for some organizations that experience regular income variances, or that generally require a little, fast advance to cover costs that will be reimbursed in anticipated income in less than a year

- Medium-Term finance is wellsprings of finance accessible for the mid-term between 3 – 5 years commonly used to finance an extension of a business or to buy expansive settled resources. It is generally the bigger measures of acquiring or the utilization of the assets that separate medium wellsprings of finance from here and now, in spite of the fact that some of the fleeting choices are accessible for the mid-term

- Long term finance: is a type of financing that is accommodated at a time of over a year. Long term financing administrations are given to those business substances that face a deficiency of capital. There are different long term wellsprings of finance. It is not the same as here and now financing which is typically used to give cash that must be paid back inside a year. The period might be shorter than one year also.

- Unsecured loan: is a loan that is issued and bolstered just by the borrower’s reliability, as opposed to by insurance. An unsecured loan is one that is gotten without the utilization of property as insurance for the loan, and it is likewise called a mark loan or an individual loan. Borrowers, by and large, should have high FICO assessments to be endorsed for certain unsecured loans.

- Eurobonds: are bonds denominated in a currency different from the currency of the countries in which they are issued and sold.

Get your project financing started

In presenting your project to Lenders an Information Memorandum must be developed. Always remember that an Information Memorandum is a selling document. Be factual and concise, but also make certain that you’re putting the asset forward to your Lenders in a compelling way. Banks have got a lot of investment and lending opportunities to consider – you want yours to stand out from the crowd.