Fundraising with Information Memorandum

Fundraising with Information Memorandum

What is an Information Memorandum?

In the context of fundraising with information memorandum, an information memorandum is a fundraising documentation used to raise capital, either debt or equity for an infrastructure or Large scale where huge capital is been deployed. Similar to other memoranda used to sell securities – such as a prospectus or offering memorandum – the IM, as its often also referred to, is a critical document utilized in the presentation to raise capital.

The information memorandum will detail key fundraising information, risks and benefits of the investment in the infrastructure project and allows prospective purchases to make both an informed decision regarding infusing their capital, and to actually invest immediately by subscribing for the securities of Special Purpose Vehicle (SPV).

Information Memorandum may also be used to sell debt or equity investments in Large Scale project finance infrastructure projects

Read on how to manage Real estate project development risks here.

Equity: In an equity offering, a project company will sell an ownership stake. The most common type of equity Information memorandum is one that is used in fundraising for shares or stock in a project company. In addition, a Project Special Purpose Vehicle (SPV) may sell units, interests of the company through the issuance of some issue sweeteners, like preferred shares or preferred stock.

Debt: In a debt offering, a project company will sell instruments such as a bond or a note. In a debt private memorandum, a project company will detail the securities being sold, such as the interest rate, maturity, and other terms of the notes or bonds. In other types of debt issuance offering memorandums, a company might offer convertible bonds or convertible notes. However, in this type of deal, the debt securities will convert to equity at a pre-determined date.

Valuation of the Project

In fundraising with Information memorandum, one of the most important reasons for developing the project information memorandum document is for the project company to showcase its valuation to prospective investors or purchasers for securities. Most times, however, the project information memorandum omits any pricing of the project company or its core businesses. This is done so the selling project company has an option by not giving away its bottom line pricing which would, in turn, most likely receive lower priced offers on the purchase.

The most important thing is that in fundraising with information memorandum, the memorandum must be prepared in a manner that it will have enough information for any company seeking to acquire or purchase the instruments been offered to undertake their own independent valuation. Once the prospective buyers have done their independent valuation they will return to the seller with an offer price.

Brickstone Partner’s Advisory Team can assist with the development of the information memorandum and the company valuation and bring in extra value by protecting project sponsors from low offers.

Objectives of Fundraising with Information Memorandum

An Information Memorandum is a written description of the business for which the client is seeking funding from equity investors or debt finance. In relation to fundraising, the objective of an information memorandum is to raise finance. In that respect, it is a sales document.

Scope of Information Memorandum in Fundraising

In fundraising with information memorandum, the detail required and hence the length of an Information Memorandum varies depending on the type of investors targeted. However, the core content is always the description of the business from a strategic, operational and financial perspective, i.e. “what is the business about”, the market, and the investment opportunity or “investment rationale” from the investors’ perspective i.e. the return on investment.

Depending on the audience in fundraising with an Information Memorandum, such memorandum is subject to a great many formal legal requirements. These legal requirements are most extensive where shares or other forms of funding instruments are offered for sale to the public. Compliance is essential.

Attributes of the Information Memorandum (IM) in Fundraising

In fundraising with Information memorandum, here is a list of several features that should be in the said memorandum:

- A thorough description of the project, business, its products and service offering;

- Offering Summary of the sale and structure of the transaction offering;

- Description of the demand market opportunities, and industry trends;

- Competitive analysis, barriers to entry for new competition and Growth opportunities and scalability;

- Project Risk Factors and Mitigating Strategies;

- Financial projections, historical performance, future projections;

- Core Management Team and Governance

- Future products and services.

Also, in fundraising with information memorandum, it is important to view the information memorandum as a marketing memorandum or document. While this is not entirely the correct term, the IM, in fact, is the best marketing document a company can possess if they are seeking a sale of any kind. Since the IM provides the necessary attributes of the company, it is therefore the most powerful tool a company can utilize during the selling process. Like any marketing document, however, a company must disclose all material information or facts and leave out exaggerations, while not omitting mandatory information, all of which can harm the chances of success.

Key Guiding Tips for Fundraising with Information Memorandum

At a high level, these marketing documents are starting to change dramatically in terms of look/feel and content. At Brickstone, we work with investment bankers (including bankers focused on large institutional real estate transactions) across West Africa. Also, they should have a good sense of where the Information Memorandum heads.

In fundraising with information memorandum, here are some observations that may be helpful to you as you draft the Information Memorandum:

-

Keep it short and sweet. Buyers and investors need to get enough information to understand the business/asset. Albeit, they want to invest their time wisely. In early 2000 these project information memorandum could be well over about 100 pages. Now, the typical project information memorandum we see is between 40 and 50 pages and they’re getting much shorter. We worked on an Infrastructure Finance deal recently at Brickstone Partners and the book was only 35 pages long. Also, we did a great job of summarizing the opportunity succinctly. We see the engagement data. It is simply a fact that readers start to trail off if a document is too long.

-

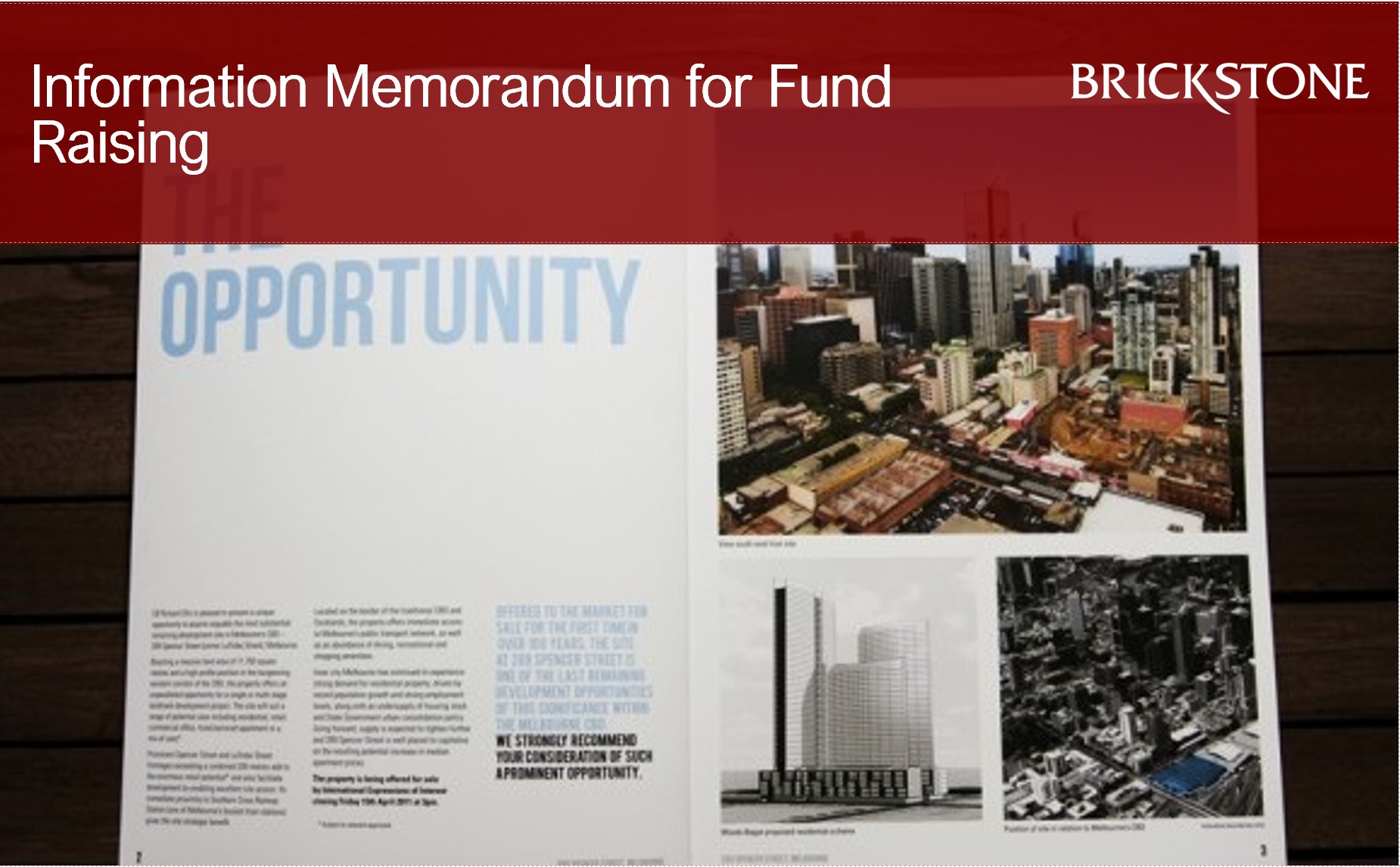

PowerPoint is taking over. In the past, the offering memo itself would have been a Word document. Now, more than 70% of the deals we work on are using landscape, PowerPoint documents rather than portrait, Word. It’s easier to write; it’s easier to read, and it makes much better use of visual elements.

- Visuals and Infographics. Buyers and investors are consuming content very differently than they did ten years ago. It’s all about video, dynamic imagery and other kinds of engaging content. This is particularly true with institutional real estate and infrastructure deals. It is possible to highlight the asset much more effectively using video and other dynamic content than through paragraphs and static images.

- Give them the info they need to analyze the deal easily and effectively. Serious buyers/investors are going to roll up the sleeves to analyze the opportunity. Put the data into their hands and let them do their work. Brickstone Partners have an Online Data room facility. Hence, this allows our client’s investors to download the financials, graphs, charts, images, maps, floor plans, etc. directly through the document embedded link. If you’re not using a platform like ours; be sure to make the information readily accessible to them in other ways.

Always remember that an Information Memorandum is a selling document. Hence, in fundraising with information memorandum, such memorandum must be factual and concise but also, make certain that you’re putting the asset forward to your buyers and investors in a compelling way. Investors have got a lot of investment opportunities to consider – you want yours to stand out from the crowd.

Why not contact us to make your Project Happen

Our advisors and consultants would be able to schedule an online meeting with you to discuss your project with the overall objective of seeking ways to achieve the “bankability” and protection of the long term asset value of your project. Request a Meeting Now